Your budget questions answered

We answer some of your most common budget-related questions.

View the proposed business plan that each service area has prepared for 2023:

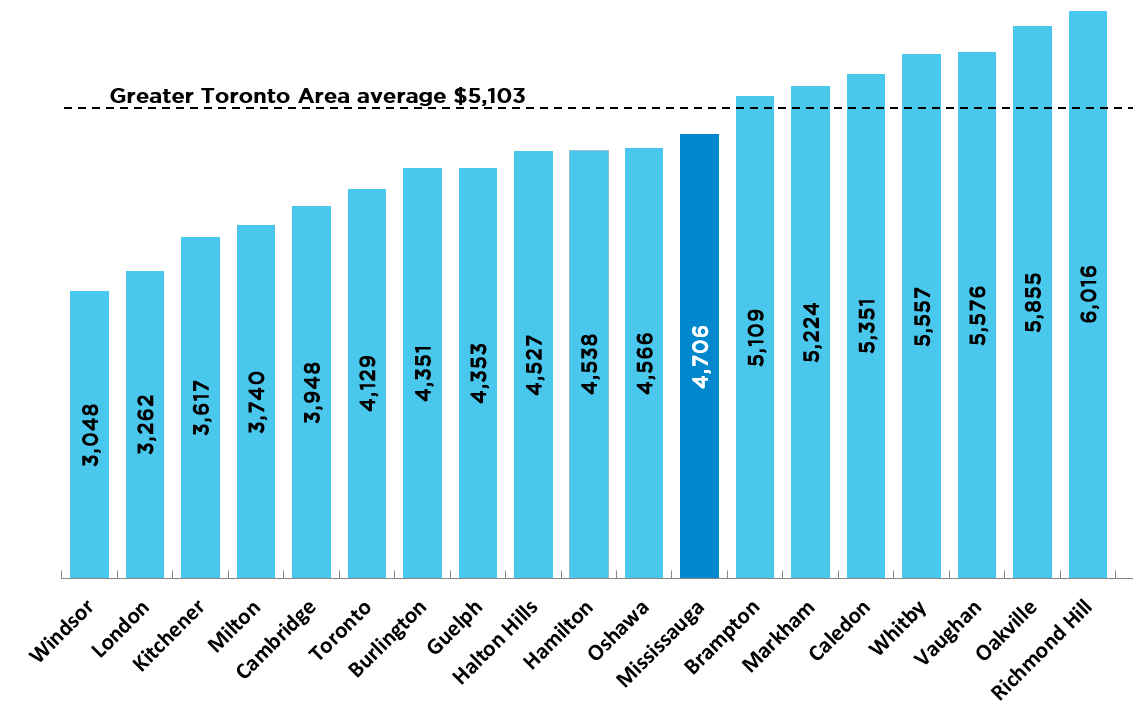

2021 Average Residential Property Tax

*Source: 2021 Municipal Study – BMA Consulting Inc.

In Mississauga, you get good value for your tax dollar.

Mississauga is a growing, maturing city. The cost to expand the City’s services is increasing as the population grows.

The City delivers the programs and services a larger city requires, for example:

- Response to 30,000 emergency incidents

- 5,680 km of road network

- Support to 95,000+ businesses

- Free public Wi-Fi in a growing number of locations

- More than 1 million Library collection items

In setting the tax rate, we strive to balance the need to maintain services and infrastructure and add new programs and facilities required to meet a growing population.

Cities operate very much like the service industry. And, when your business is to deliver services, most of the costs are for people. In Mississauga, firefighters, transit operators, librarians and fitness instructors are examples of the people who deliver the services residents rely on every day.

Mississauga wants to attract the best-qualified people to deliver our programs and services. We benchmark against other municipalities and public sector organizations to ensure we offer competitive yet cost-effective salaries and benefits that compare with similar organizations across the country.

We challenge ourselves to find efficiencies each year. We’ve saved more than $73.6 million since 2009 by innovating and improving processes. Through our commitment to continuous improvement, we have adopted Lean and other tools to improve the way we work.

For example, we’re finding efficiencies and new ways to save money by moving to an online Active Guide, eliminating MiWay paper passes and switching to LED street lighting.

Learn more about Mississauga’s commitment to Lean and continuous improvement.

The City of Mississauga is a municipal leader in providing quality services and programs while continuing to build for the future in a financially responsible way.

Standard and Poor’s Rating Services (one of the world’s leading providers of independent credit risk research and benchmarks) has endorsed the City’s ‘AAA’ credit rating for 18 years in a row.

According to Standard & Poor’s, the City’s financial management including its policies, audited statements and detailed budgets, have a positive impact on its credit profile.

They also note that the City’s information provides “transparent, easy-to-access disclosure.”

Other City revenues include user fees, and transfers from the provincial and federal governments. Property taxes are by far the largest source of revenue for the City.

Furthermore, the Ontario Municipal Act limits how the City can generate new non-tax revenue. The City of Mississauga and other Ontario municipalities have asked for changes to the Act to give local governments more revenue-generating options.

As a result of recent changes to provincial law, we introduced a four per cent Municipal Accommodation Tax effective April 1, 2018 which will help to pay for tourism-related services in Mississauga.

Not necessarily. The re-assessment of your home is done by the Municipal Property Assessment Corporation (MPAC), a not-for-profit corporation. When the City gets revised assessments for all properties on its property tax roll, it adjusts the tax rates accordingly. So, if your assessment increases at the average for the whole City there will be no impact on your tax bill.

However, if it increases by more or less than the average there will be an impact. Increases in assessments are phased in over four years; if you disagree with your re-assessment, you can ask MPAC to reconsider your assessment. If you don’t agree with MPAC after they have reconsidered, you can appeal to the Assessment Review Board.

Residential tax bills include taxes collected for the Region of Peel and for education, as well as City taxes. This means that only a portion of the increase residents will see on their 2022 property tax bill is related to the City budget.

The City approved a 4.3% increase to the budget which means a 1.5% increase on a residential property tax bill.

For the owner of an average, detached, single family home in Mississauga (value $730,000), a 1.5% overall tax increase comes to about $91.

The City of Mississauga operated for many years under a pay-as-you-go philosophy. It is important to understand that municipalities must balance their operating budgets and can only take on debt for capital purposes.

As the City was developed, infrastructure was built with revenue from development projects. The City is now largely built and development revenues are declining. As well, our infrastructure is starting to age and replacement is costly.

A debt management policy for the City Of Mississauga was approved on December 7, 2011; it sets policies for responsible use of debt. The City took on debt for the first time in 2013 to fund capital projects such as LED street lighting and the Mississauga Transitway (BRT).

The City is required to start paying off debt or to put money aside to pay off the debt in the next year’s budget, similar to a mortgage on your house. The City’s Infrastructure and Debt Levy includes funding to start paying off the debt. The City’s debt policy ensures debt continues to be manageable.