Bill 197 Illustrates the Importance of Municipal Advocacy

City building | November 4, 2020

Today, General Committee received staff reports from Planning and Building and Corporate Services which examined the impacts of the Government of Ontario’s COVID-19 Economic Recovery Act, 2020 (Bill 197) to Mississauga.

As described in the staff reports, the Act contains amendments to several statutes that affect municipal planning, development charges, environmental assessments and transportation infrastructure. Changes to the Planning Act, which replace those previously proposed as part of the More Homes, More Choice Act, 2019 (Bill 108), are significant and come as the result of strong advocacy efforts from Mississauga and other municipalities across the province.

The changes originally proposed in Bill 108 would have significantly reduced the City’s ability to provide adequate park, recreation and library infrastructure to support new development. The City advocated for a number of changes to Bill 108 and the province largely listened.

“The amendments to the Planning Act in Bill 197 are generally positive for Mississauga and largely a return to the status quo,” said Andrew Whittemore, Commissioner of Planning and Building. “We are pleased to see that the new legislation maintains the existing provisions for parkland dedication, cash-in-lieu payments, and the alternative parkland rates. In addition, the new structure of the Community Benefit Charge provides us with the flexibility to fund growth-related capital costs for services such as affordable housing, public art, community services, parking or other Council priorities.

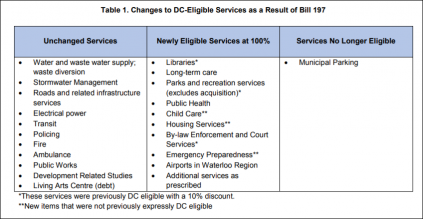

Bill 197 includes changes to the Development Charges Act. Development Charges are fees collected by the City for the development and redevelopment of land. Development Charges are the City’s primary revenue tool for funding growth-related capital costs. This reduces the overall burden on property taxes.

“These amendments come as welcome news during this challenging year as we continue to feel the impacts of COVID-19 on Mississauga’s budget,” said Gary Kent, Commissioner of Corporate Services and Chief Financial Officer. “Changes to the Development Charges Act eliminate the 10 per cent discount to soft services (libraries, parks and recreation). These were previously proposed to be recovered through the Community Benefits Charge and are now fully recoverable through development charges. This moves us closer to the ideal that ‘growth should pay for growth’ but is still not an absolute.”

To implement the CBC, a by-law will need to be developed. It is anticipated that this process will occur in tandem with the City’s update to its Development Charges by-law that is set to cmmence in early 2021.

Tags

Media Contact:

City of Mississauga Media Relations

media@mississauga.ca

905-615-3200, ext. 5232

TTY: 905-896-5151